The consumption of honey, which has been sought out by humans for use as food and medicine for thousands of years, has been increasing in recent decades with rising incomes and attention paid to food choices and health. In two decades, honey consumption in the U.S. has risen from 1.2 pound per capita per year to 1.9 in 2021. In the European Union, per capita consumption rose from 1.5 to 2.1 pounds per capita over the same period. While this might appear to be a boon for U.S. and EU beekeepers, honey is a heavily traded product, and imports from large producers such as Argentina, China, Brazil, or India have captured much of the demand growth on U.S. and European honey markets. The two regions are now the two largest importers of honey globally, with 20% of all traded honey going to the U.S. and 40% to the EU, according to the United Nations Food and Agriculture Organization’s trade data for 2015-2020.

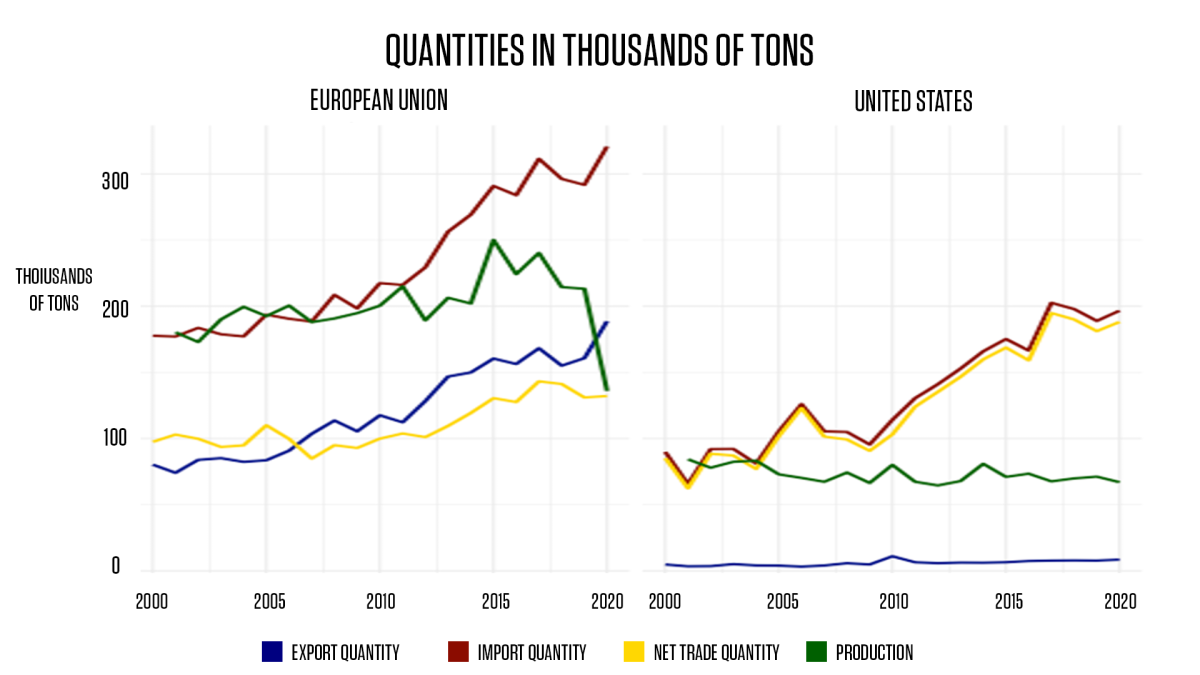

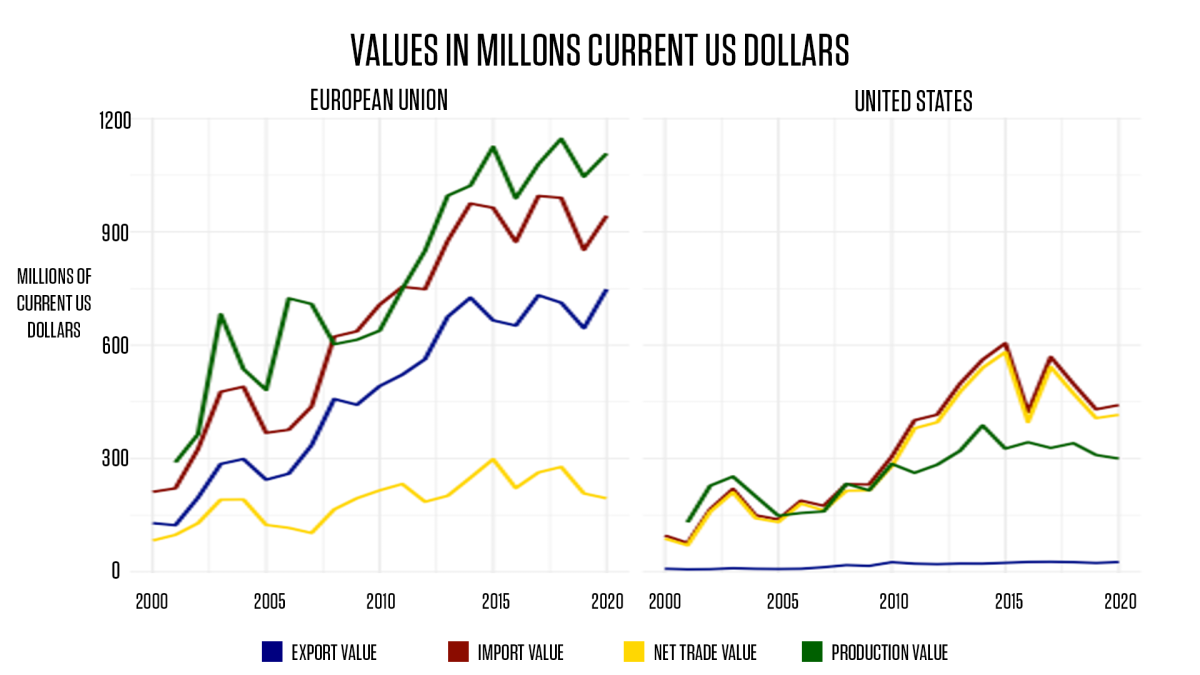

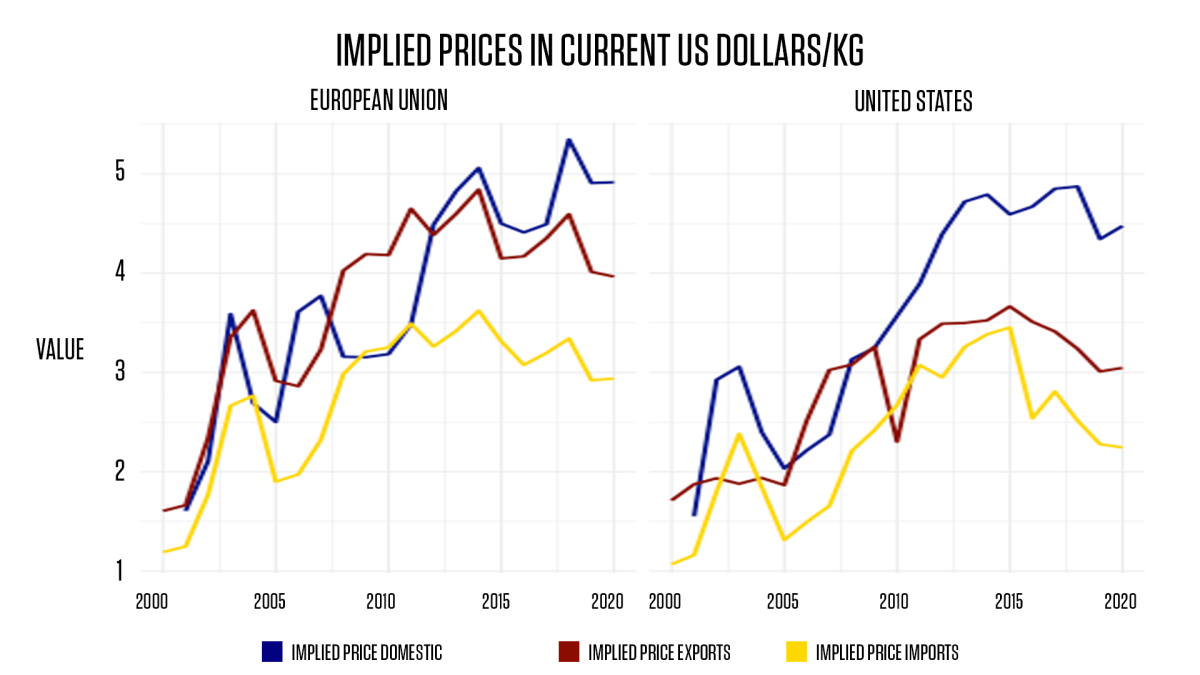

The figures below show that imported quantities have grown to surpass domestic production in both regions. In the United States, from where exports are small, over 60% of honey available for consumption is imported. Trade and production figures in value terms confirm the growing presence of imports in the two markets but also reflect the fact that imports are more often used in manufactured products and fetch lower prices than domestic honeys on average.

International trade increases the variety of products available and lowers the prices for consumer products.

However, for certain food items, including honey, consumers face a risk that imported products have been purposefully adulterated—predominantly with low- cost alternative sweeteners—and/or mislabeled.

The economically motivated misrepresentation of food products is frequently referred to as food fraud. Food fraud has occurred in numerous food products and attributes, including—besides honey—olive oil, wine, milk and cheese, beef, seafood, organic grains, and other high-value products. While the risk also exists for domestic honeys, enforcement of standards and tracking of origin is more challenging for traded products that can be blended and repackaged, as is the case for honey.

A report issued by the European Commission in March 2023 assessing the frequency of honey adulteration with alternative sweeteners found that nearly half of the 320 samples tested had been adulterated. A variety of actions have been taken to deal with honey fraud, including investments in detection technology that overcome methods of adulteration that have been frequently employed, such as the use of isotope-compatible rice syrup as a low-cost substitute or of pollen- filtering to hide the origin of the honey. Other policy responses include increased inspection at borders for honey originating in certain countries.

While food fraud is a major concern for the food industry, there is relatively little known about consumers’ awareness, attitudes, and behavior with respect to food fraud.

Surveys of consumers have concluded that consumers’ awareness of food fraud is limited—with some surveys finding that most respondents were unaware of food fraud as an issue, and that consumers’ assessments of food fraud risk reflects incomplete or biased information.

Estimates of the impact of food fraud on consumer food choice and valuation is limited by the nature of the phenomenon: it is difficult to study consumer behavior in real-world markets in the face of food fraud because it is difficult to anticipate when a food fraud incident will be detected and made public. Even once an event has been identified and reported, the percentage of consumers in a given market that will have seen news about the fraud is hard to ascertain.

The challenges of studying consumer response to food fraud incidents in market data has led to most evidence coming from experiments. In these experiments, researchers study the choices of participants who receive information about food fraud in the experiment versus those who do not receive this information. Research has been conducted on the impact of information about food fraud on consumer valuation of olive oil, seafood, and honey. Unsurprisingly, these studies finds that consumers’ valuation decreases markedly for products implicated as potentially fraudulent by information provided to participants in the experiment.

We recently conducted an experiment with U.S. consumers on valuation of honey from different origins.

Examining valuation—without exposure to information about honey fraud— participants in our study were not willing to pay any more for U.S.-produced honey than imported honey, which suggests that they did not expect U.S.-produced and imported honey to provide markedly differing levels of quality.

If consumers do not view U.S. and imported honey as different products, they will select whichever is offered at a lower price, potentially explaining the increasing share of U.S. consumption that comes from imported honey at the expense of domestically produced honey. However, as honey fraud incidents are increasingly detected and reported upon, consumers may adjust their baseline expectations of fraud and change their preferences accordingly. In earlier work on olive oil fraud, consumers who had prior knowledge of fraud valued olive oil less than those who did not have prior knowledge. Once information was provided, fraud-aware consumers reduced their valuation less than fraud-unaware consumers.

In a paper by Wu and colleagues published in 2015, information suggesting that imported honeys might be adulterated with heavy metals and illegal pesticides led participants to be willing to pay a significantly higher premium for local and U.S.-produced honey over imported honey than participants who did not see that information. However, many of the cases of honey fraud that have been caught and reported involve the adulteration of honey with low-cost sweeteners rather than dangerous substances. It is quite possible that consumers would respond differently to food fraud information that indicates the buyer may get rice syrup rather than honey instead of information suggesting exposure to dangerous substances.

Changes in consumer preferences for the origin of honey in response to information about honey fraud may alter the trend of an increasing presence of imports in U.S. and EU honey markets.

Increasingly sophisticated detection methods may support this consumer-driven change by removing more fraudulent honey from the supply chain, though previous advances in detection have been met with enhancements in disguising adulterated honeys.

However, other factors loom large in the future of international honey markets as well. The last 15 years have seen a significant rise in the profile of bees and pollination, and policies aiming to encourage beekeeping have gained support. In parallel to fraud concerns, the United States has, for instance, implemented prohibitive import tariffs on anti-dumping grounds for honey from China (2005) and more recently from Argentina, India, Brazil, and Vietnam (2021). While U.S. honey imports dropped briefly after 2005, they soon resumed their upward trend, suggesting that these recent tariffs may not shift consumption towards U.S. producers in the long run. The future of global honey markets is thus fraught with uncertainty in which adulteration and other quality concerns for consumers in Europe and the U.S. will play a key role. Consumer response to food fraud, in general, warrants additional attention, as behavior in complex, real-world markets may differ from the simple contexts presented in experiments on consumer behavior. The recent proliferation of research on fraud detection methods may yield ongoing increases in the sophistication of detection techniques and subsequent advances in the strategies employed by those engaged in honey fraud to hide their efforts.

Source: Authors’ calculations from FAOSTAT data.

Gustafson is an Associate Professor, Department of Agricultural Economics, Yeutter Institute Faculty Fellow. View Biography

Champetier is an Independent Economics Consultant. View Biography